Author: Alan Sherman, VP of Marketing Strategy

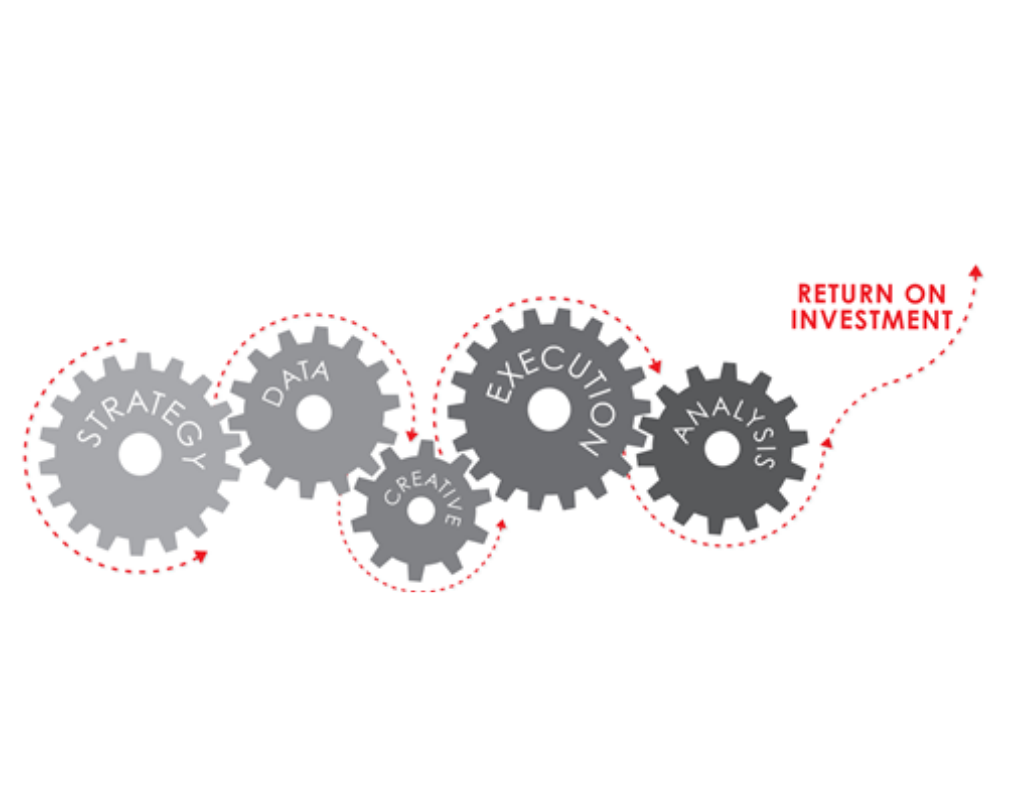

Quite often, when we work with clients in direct mail marketing, creative development is the first focus. But, just as in any marketing channel, who we target is just as important, if not more so for driving increased direct mail response and a successful direct mail campaign. For a full-service direct marketing company like Nahan, using data in direct mail marketing is a crucial component of an integrated success chain that includes strategy, data, creative and production execution.

Direct mail provides more data points to target against than any other marketing channel. The typical national data compiler manages over three thousand data points per person.* Combine a multi-sourced wealth of data with sophisticated predictive analytics, and we can precisely rank prospects based on their propensity to respond (or other desired outcomes).

Let us take a look at typical data used by various direct mail industry clients. In the interest of time and space, what follows is not an exhaustive list.

Financial Services and Insurance – Credit Data

For financial and insurance clients, we see widespread use of credit bureau prescreened data – both in terms of trigger (credit or insurance inquiries by consumers) and broad market (often dictated by credit score and other data points) campaigns.

As a direct marketing service provider, Nahan partners with credit data agents, which can provide unique sources of value. Credit data agents typically receive and maintain real-time data from all 3 main credit bureaus, providing a comprehensive picture of all credit behavior across bureaus. More data across all 3 bureaus means more net qualified names, typically 15-20% more, and improved credit decisioning.

It also means more flexibility in terms of FCRA regulations, allowing for counts to be more easily run before actually pulling a file. Typically, when one pulls a complete prescreened credit file, one is obligated to make everyone on that list a firm offer of credit. Credit data agents have more flexibility in this regard. Custom models can make use of both credit and non-credit data for increased predictive power.

While credit data is usually the go-to data source for most financial and insurance acquisition mailers, it can often be supplemented by Invitation to Apply (ITA) data, which is primarily driven by a lifecycle event – such as college graduation, marriage, having children and buying a home. While ITA prospects are typically not as responsive, it is less expensive, and can be tested and paired with credit data as an effective supplemental data source.

Multiple Industries – Modeled Compiled Data

Compiled data is just that – data compiled from multiple sources and then linked to individuals and households. It’s typically used in travel, healthcare, retail, telecom, and auto direct mail. There are a number of medium and large-sized data compilers that we partner with to provide the best data for our clients. Compiled data typically includes demographic, psychographic, and attitudinal data.

Demographic data includes data elements like age, gender, income, occupation, and more.

Psychographic data is focused upon people’s interests and hobbies, often obtained via surveys, donations, and specialty lists.

Attitudinal data reflects attitudes and belief systems, typically from surveys and donations made to non-profits.

Compiled data is best paired with predictive analytics to identify the data elements that will give the greatest response.

Catalogers, Non-Profits, E-tailors and Others – Cooperative (Co-op) Data

Co-op data is customer purchase data collected from thousands of co-op members and maintained in a database. Typically, a member marketer must provide their customer data on a regular basis to join and participate. Co-op members include companies from the catalog, retail, etail, continuity, non-profit, publishers, finance, insurance, and business-to-business industries. Some co-ops focus on non-profit donation behavior specifically.

Co-ops collect over 1500 data elements for a given household and cover 190MM U.S. consumers. The depth and granularity of the data can vary by co-op. Given that customer behavior is often the most predictive of future behavior, this data is very powerful in its ability to predict the future response and purchasing.

Using marketer-provided customer purchase data, the co-ops use predictive models to find prospects elsewhere in the database with similar product and purchase behavior. Co-op data has long been a go-to data source for catalogers, replacing many of the more expensive specialty, “vertical” lists that exist, such as magazine subscriber files.

Business-to-Business (B2B) Data

B2B direct mail data used to come from two main data sources – Data Axle (formerly InfoGroup) and Dun & Bradstreet. They are still major players providing excellent data. Both, along with a continual flow of new players, now offer much more than the traditional data points like annual sales, number of employees, SIC code, and NAIC Code. Data points such as B2B buying behavior, public filings and linked consumer information all provide additional targeting insights. Because people change jobs much more frequently than they change addresses, B2B data is more challenging and labor intensive to maintain and keep up to date, resulting in a higher cost.

The Role of Analytics

The performance of all data mentioned here can and should be enhanced by predictive analytics. We simply can’t leverage any of these types of data to their full potential without the use of modeling to prioritize prospects. While a predictive model adds to the cost, it usually pays for itself in the first direct mail campaign with the increased direct response it produces. Depending on the circumstances, the model can be re-used until market conditions change. Machine learning and artificial intelligence have sped up the modeling process, and in certain cases, such as co-op data or credit models, new models may be built with every direct marketing campaign.

Our Data Role

Nahan has deep and long-time relationships with many types of direct mail data providers and list brokers. We can determine which source is the right fit for our clients’ objectives. Typically at a lower cost than our clients can obtain on their own. Our expertise ensures the best possible data at the best possible price. For any questions about data, please feel free to reach out to me at alan.sherman@nahan.com.

*Source: WebFX

Bio: Alan Sherman is our Vice President of Marketing Strategy. Alan enhances Nahan’s current value proposition with strategy solutions that support new/existing client relationships. For clients, he leverages market, customer, and competitive intelligence to build achievable strategies for omnichannel marketing success. His marketing plan strategies include targeted data, predictive analytics, testing and creative that drive ongoing client performance improvement. In his spare time, Alan enjoys spending time with his family, traveling, going to concerts, watching sports (he’s a fan of the NY Giants, Boston Red Sox and Celtics) and walking the dog, even though it was just out.