ChatGPT….a term that is likely newer to our vocabulary, but undoubtedly, a word you’ve seen pop-up at an increasing rate anytime you open an internet browser or a smart device. But have you considered the impact of ChatGPT on direct mail marketing?

At the start of this article, we were confronted with a dilemma. Do we ask ChatGPT for an outline? Do we have it write the entire article (as a meta-experiment of course)? Or do we ask it to provide some background research on the topic to get us started? This seems to be a common situation that content marketers now face.

And of course, this is just a minuscule example of how this fast artificial intelligence is impacting marketing departments and other knowledge workers.

According to a recent CBS News article, 30% of professionals are already using ChatGPT for their jobs, and if we had to speculate, it’s likely the marketing industry may be among the leading users.

At Nahan, we believe that AI language models such as ChatGPT have the potential to significantly impact the direct mail channel in a positive way, but how fast and to what degree are very much uncertain, like so many things with the emerging AI revolution.

In this article, we will discuss how direct mail marketers can use ChatGPT to enhance their campaigns, as well as some of the limitations and potential risks to consider.

And yes, we did ask ChatGPT for some help in writing this article, but it is mostly human generated!

What is ChatGPT?

At its most basic level, ChatGPT is a chatbot that uses Natural Language Processing (NLP) and Artificial Intelligence (AI) to generate responses to user input. Its models are built by analyzing enormous amounts of text from the internet and other sources like books, social media, new articles and academic papers. The algorithms can then use this data to understand human language, identify patterns, and generate responses.

It’s currently available to use for free on the Open.ai website, and recently a paid PRO tier of $20 a month was created. It has been integrated into Microsoft’s Bing search and Edge browser, with plans for rolling out a new product called Co-Pilot which will be integrated into many of the Microsoft Office applications, including Word and Excel.

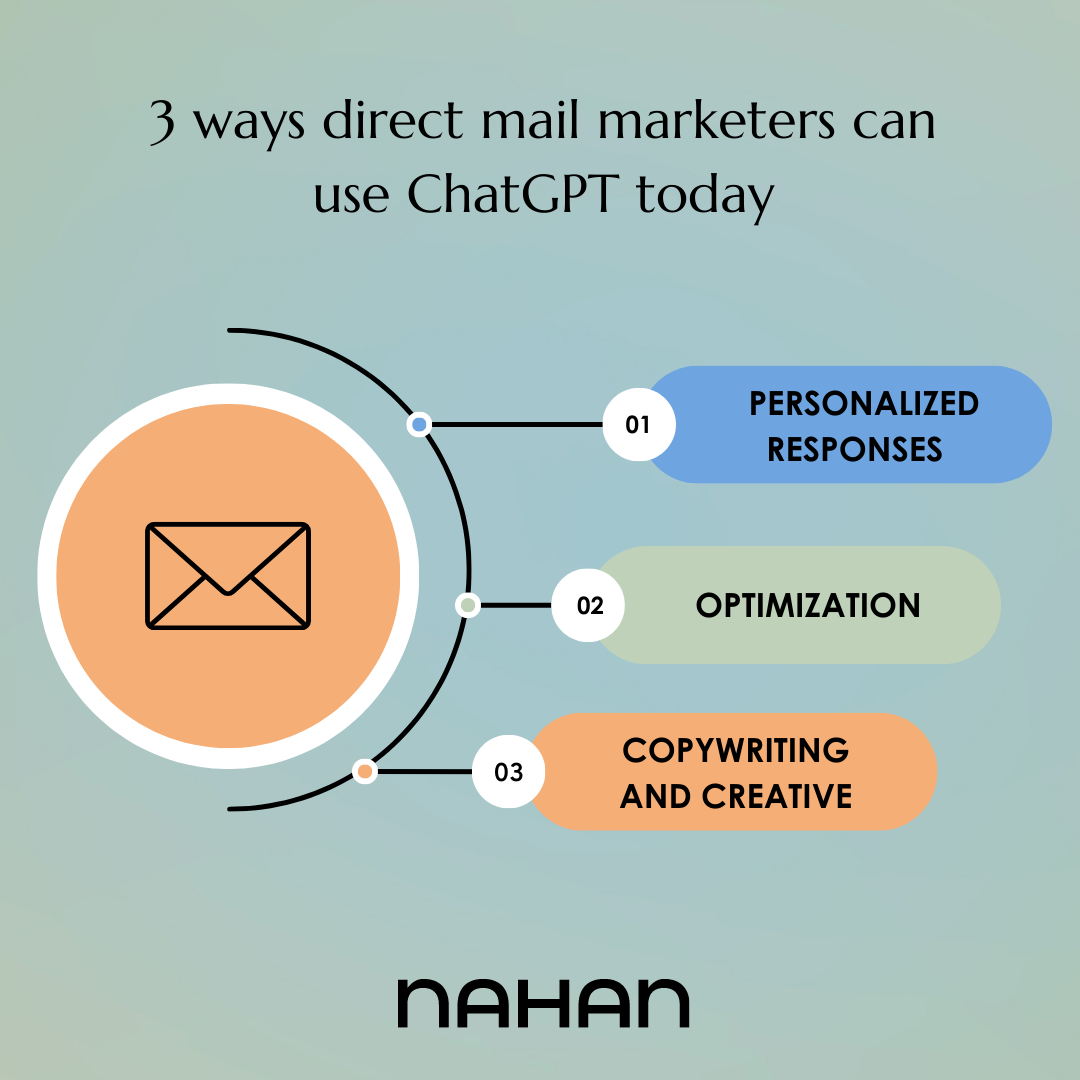

Three Ways Direct Mail Marketers Can Use ChatGPT Today

The extent that ChatGPT is being incorporated into direct mail workflows cannot be known in full just yet. From our conversations with clients and others in the industry, we know that people are starting to tap into its great potential on certain tasks.

Of course, AI and machine learning technology have been a part of the direct marketing industry for several years on the data side of the equation, especially when it comes to targeting.

But what are some other areas where generative AI could have an impact? Let’s look at a few use cases.

Personalized Responses

Generative AI’s ability to generate personalized responses based on user input has the potential to enhance the personalization of direct mail campaigns.

For example, a direct mail piece might include a call-to-action that invites the recipient to chat with a chatbot. Once engaged, the chatbot can ask questions and generate personalized responses based on the user’s answers.

Optimization

Direct mail marketers are always focused on optimizing campaigns. However, finding the right formula can be time-consuming, and expensive. Artificial intelligence and chatbots could have a significant impact on that process by generating real-time feedback on campaigns. This in turn will allow for more robust and experimental testing with the goal of generating a higher ROI.

By automating certain tasks, such as testing and targeting, AI can help marketers identify the most effective strategies quickly and efficiently, leading to more successful campaigns.

Copywriting and Creative

Direct Response copywriting is a core part of direct marketing campaigns. Best practices have been defined by the industry over the years, and this is exactly the type of structured data tools like ChatGPT have been trained on.

Generative AI will allow marketers to generate ideas, outlines and research and a high volume of copy in lightning speed. This will give marketers the opportunity to expand possibilities and potentially lead to greater creativity.

By inputting key information about the target audience and marketing goals, ChatGPT can provide customized content optimized for engagement and conversion. This can save time and resources while improving the overall effectiveness of direct mail campaigns.

Limitations of Using ChatGPT for Direct Mail Marketing

While ChatGPT can be a powerful tool for direct mail marketers, there are some limitations to be aware of:

Accuracy

It may not always generate entirely accurate or relevant responses, although they can sound very convincing. Currently, ChatGPT has a knowledge cut-off date of September 2021. It’s important to review and verify to assure accuracy.

Originality

ChatGPT is capable to generating dazzling, convincing, and sometimes even very funny results, but it does require trial and error with the prompts, otherwise there’s a risk that output will sound like more generic marketing copy and nobody wants or need more of that. Due to this limitation, copywriters will still have job security. Human touch and talent are still critical to the process of refining and enhancing the ideas AI outputs.

Data Privacy

As with any tool, precautions need to be taken to assure that your proprietary data is safe and secure, so at this point you most definitely do not want to share that or any private customer information.

Legal Risk

The insurgence of AI capabilities in marketing is new. And while very tempting to use in any way you can, its newness means that laws and regulations have not yet caught up with it. We simply don’t know the answers to all the legal and ethical questions that ChatGPT may bring up with its use in marketing.

As the industry learns more about generative AI, there will no doubt be more clarity on some of these limitations, but for the time being, caution is recommended.

Takeaways for Direct Mail Marketers Using ChatGPT

The marketing industry understands hype better than just about any other. In fact, it’s marketers that help build and generate hype for brands. At this point, the hype around ChatGPT and generative AI is impossible to avoid, and likely won’t dissipate anytime soon.

ChatGPT is certainly one of the most impressive, and potentially industry changing tools to come around in a long time. We believe the hype is real and that the direct marketing industry needs to start experimenting with these tools because, well, your competitors are going to and the risk that you fall behind is very real. To summarize:

- Direct mail marketers can use ChatGPT for personalized responses, optimization, and copywriting.

- There are limitations to be aware of, including accuracy, originality, and data privacy.

- Direct mail marketers should start experimenting with ChatGPT to stay ahead of the competition and take advantage of its potential benefits.

- The integration of AI technology is new, and thus best practices are ongoing. However, we recommend this source as a starting point for getting your feet wet in learning how to form prompt questions for AI.