Author: Joseph Jachimiec, Security Administrator

SAINT CLOUD, MN – MAY 14, 2020 – Nahan Printing, Inc., award-winning provider of commercial print, direct mail, and digital solutions, announced its achievement of Payment Card Industry Data Security Standard (PCI DSS) Compliance and Certification for 2020.

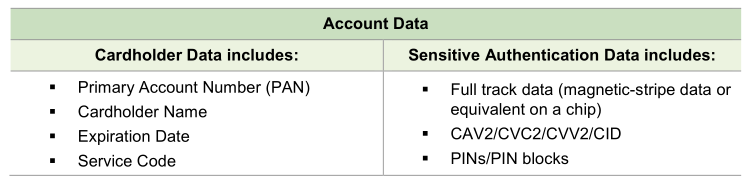

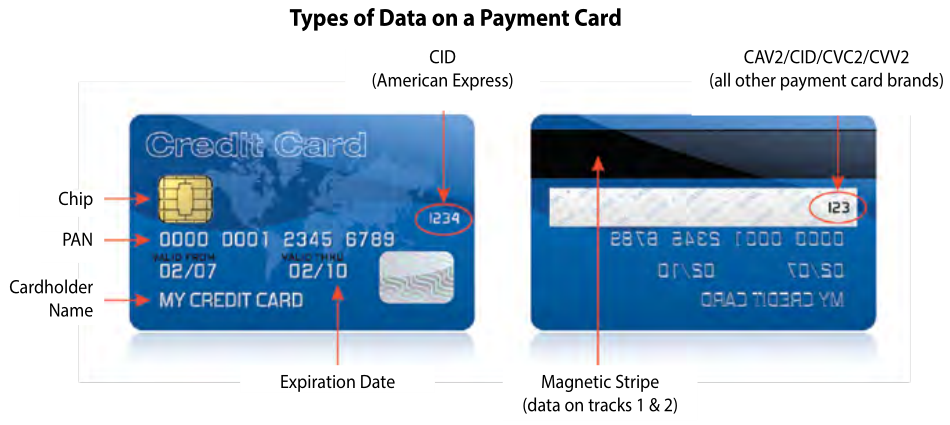

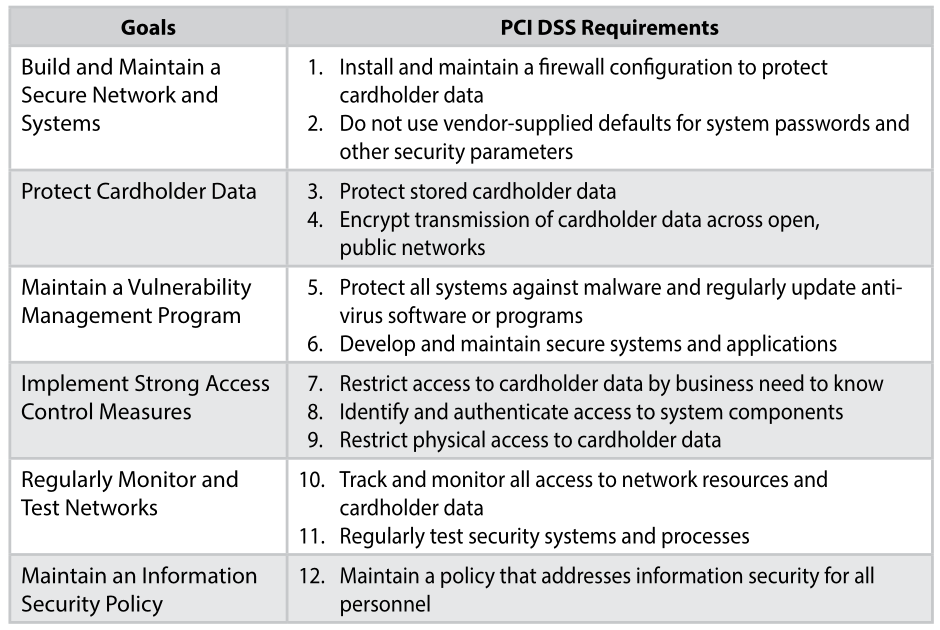

PCI DSS is an information security framework designed by the Payment Card Industry Security Standards Council (PCI SSC). PCI Compliance is for entities that transmit, process, or store credit card data. The standard guides organizations in protecting cardholder data by preventing fraud and securing Cardholder Data Environments (CDEs).

2020 marks the fifth year in a row that Nahan has earned the demanding certification. To meet compliance requirements, Nahan performed ongoing management and auditing of physical, technical, and administrative controls of their CDE throughout the year.

The successful audit resulted in Nahan’s Attestation of Compliance (AOC) for Service Providers. The AOC reviews Nahan’s compliance in detail by assessing the 12 main requirements of PCI DSS. Requirements include maintaining a vulnerability management program, implementing strong access control measures, maintaining information security policies, and more.

FRSecure LLC of Minnetonka, Minnesota, conducted Nahan’s PCI audit. As a PCI DSS Qualified Security Assessor (QSA), FRSecure provided the necessary expertise to evaluate and consult Nahan on their PCI DSS compliance.

“Achieving our PCI certification is one of the yearly milestones of Nahan’s ongoing Information Security Program,” stated Curt Tillotson, Nahan’s Chief Operating Officer.

“Our commitment to information security doesn’t stop with our PCI environment, either. It extends throughout our organization. Our customers not only appreciate this, they require it.”

– Curt Tillotson, Chief Operating Officer, Nahan Printing

About Nahan

Nahan Printing is a Minnesota-based, independent, family-owned, world class printer committed to providing end-to-end solutions that add value to clients. Since its inception in 1962, Nahan has specialized in catalog and direct mail printing for industries such as retail, financial services, non-profit, and hospitality. With a client roster of legendary brands, Nahan prints iconic work that represents the highest level of quality and innovation in the industry. For more information about Nahan, please visit https://www.nahan.com/.

Image by Steve Buissinne from Pixabay